How's it going, everybody? This is Beat the Bush. Today, I'm going to show you how to fill out your W-4 form properly, so that you do not owe the government any money and you do not get an excessive tax return at the end of the year. If your tax return is more than a thousand dollars, it's generally not a good idea because you're essentially giving the government a loan of $1,000 or so for the whole year. Instead, if you put that money in the bank, you can easily get a guaranteed return of maybe ten dollars or something for that $1,000. For people with credit card debt, filling out your W-4 form properly is a really good thing to do. This way, you're going to get a little bit more money back so that at the end of the year, you don't get a big refund. The extra amount you get can be used to pay off your credit card debt, which translates to not paying a lot more interest. This can save you a lot more money compared to putting the money in a savings account where you only earn maybe one point two percent. With credit card debt, you could pay as much as 20 percent interest, so paying it off using the money from your W-4 form is like getting free money. Some people actually prefer a large tax refund because they treat it like a bonus. They think of it as free money that they can spend wherever they want. It's kind of like a savings program with the government, where you leave them extra money and then they give it back to you at the end of the year. If you prefer to think this way, that's fine. But keep in mind that...

Award-winning PDF software

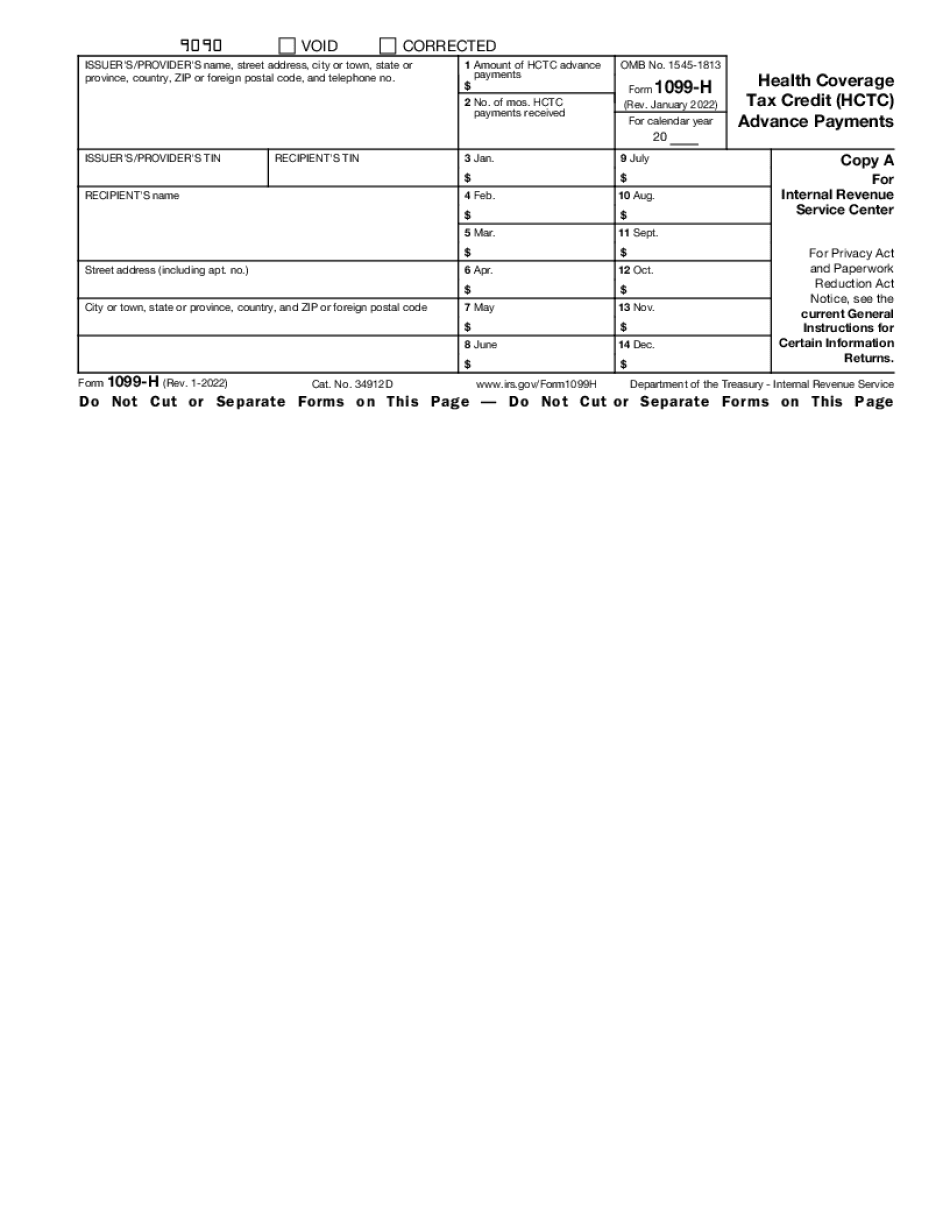

1099-H Form: What You Should Know

When Are Advance Payments Taxed? • When the advance payments are made in response to: Taxpayer requests that the payment be made after the health coverage is actually made on Individual's behalf. Taxpayer requests that the payment be made during filing, under penalty of perjury; Taxpayer request(s) that the payment be made during closing any of the health insurance policies or arrangements. However, the advance payment must be included on the returns of only the policyholder(s). If you get an advance payment from Health Insurance Provider (Health Insurance Provider) for you and your qualifying child(men) and you have not been assessed a penalty for failing to file timely, it will be treated as an extension of the time allowed for filing an original return for that year. If you get an advance payment from a Health Insurance Provider for you and your spouse and have been assessed a penalty for failing to file timely, it will be treated as an extension of the time allowed for filing any subsequent return for that year. To report the advance payment, you must file an advance notice of excess premium, Form 8889, with your federal income tax return. For additional instructions on reporting advance payments, see page 13. Can I claim an exemption for a child who isn't covered by his/her parent's health insurance plan? The child's claim for an exemption from the health insurance tax is evaluated from the date the child first receives insurance coverage, not from the date the first health care services are rendered by the plan. The “first date of coverage” is the date the child first acquires coverage, not the date the child first enrolls in the plan. It isn't necessary to wait until the date a health plan is first offered to someone to begin taking the tax deduction. What if I have health insurance that was provided to me by an emergency worker, physician or nurse while I was in the military? If you have coverage for your military dependent from an outside organization, you must file an advance payment of the premium with that organization on Form 10963. Otherwise, you can file Form 1099-H (see above), even if you're required to file the Form 10963 to get your Form 10963. What if I have health insurance that was provided to me by a health insurance provider? You need to file Form 1099-H if your insurance was provided by a health care provider.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-H, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-H online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-H by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-H from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1099-H