I'm here with Pastor Roger from the WA and his little boy Levi. Roger pastors at the Irving Seventh-Day Adventist Church in the Dallas-Fort Worth metro area. You began to experiment with filling the baptistry on Sabbath. Tell us what happened with that. At first, I have to confess, I never believed it. I could never believe that if I filled the baptistry myself, people would still come forward. But ever since the last two months, it has been happening every single Sabbath. We have people coming just to get baptized. The first thing I learned is that I don't need a major event to bring people to God. Just a normal Sabbath is enough for them to give their life to God. We started feeling good about this, but most importantly, the members themselves keep the work going. They don't just visit any baptized people. I say that this idea is divine. It's what God really intended us to do. I am so confident that if you try this in your church, there will be no one as surprised as me. Try and see how faithful God is. May God bless you. So, how did you decide to do the very first one? You were skeptical, but how did you say, "I'm going to try this"? First of all, I put my mind to it. I realized that it takes so much work to put together a major event. So, it's more work to do that than just to be open and receptive. I said, "Look, anytime you want to be baptized, come forth and get baptized." And guess what? Then people actually came forth. Some wanted to get baptized on the same day, while others were willing to go through a preparation class. The most important thing is...

Award-winning PDF software

1099 int Form: What You Should Know

Tax forms you will have to fill and complete on forms provided by your bank and/or broker, or pay to your account in another way, such as electronic funds transfers. However, there are Certain taxpayers may be eligible only for Form 1099-INT, which is made by the tax collector at Form 1099-INT, Interest Income — IRS Form 1099-INT. (Rev. January 2022). Cat. No. 14510K. Interest. Income. Copy A. For. Internal Revenue. Service Center. Department of the Treasury — Internal Information on the Form 1099-INT. Interest income, including a form 1099-INT is reported on Form 1040, W-2. Interest income paid to your broker to help you save or invest is reported on Form 1099-INT. Who Should File? You need to file Form 1099-INT if you were the beneficiary(s) on any qualified distribution of a qualified plan or qualified investment of your employer, an officer or director of the corporation for which the distribution happened, or if the qualified plan or qualified investment was made through the employer's retirement plan or with your employer's plan. The qualified distributions were made to you, the beneficiary(s) on the qualified plans or qualified investments as a direct result of your conduct as an officer or director or employee of the corporation and not for a purpose unrelated to your corporation's interests. If you, the shareholder of the corporation for which the distribution happened, was the employee of the corporation for the qualified distribution and your participation or influence as an employee of the corporation resulted in you being the beneficiary(s) of the qualified distribution, no Form 1099-INT is required. For more information contact the IRS at or visit their Website. You may also contact them at, if you filed your return after April 2, 2009. If you filed for an extension, and you wish to check the status of your return, go to their Website and click “View your extension request.” A status update will appear to you. See their forms for what the current filing status is. Then, on the next page click “Request for Examination,” and your extension request will be presented to you. Your business (i.e. “sole proprietorship”) The sole proprietorship, as an organized practice, is exempt from federal income taxation.

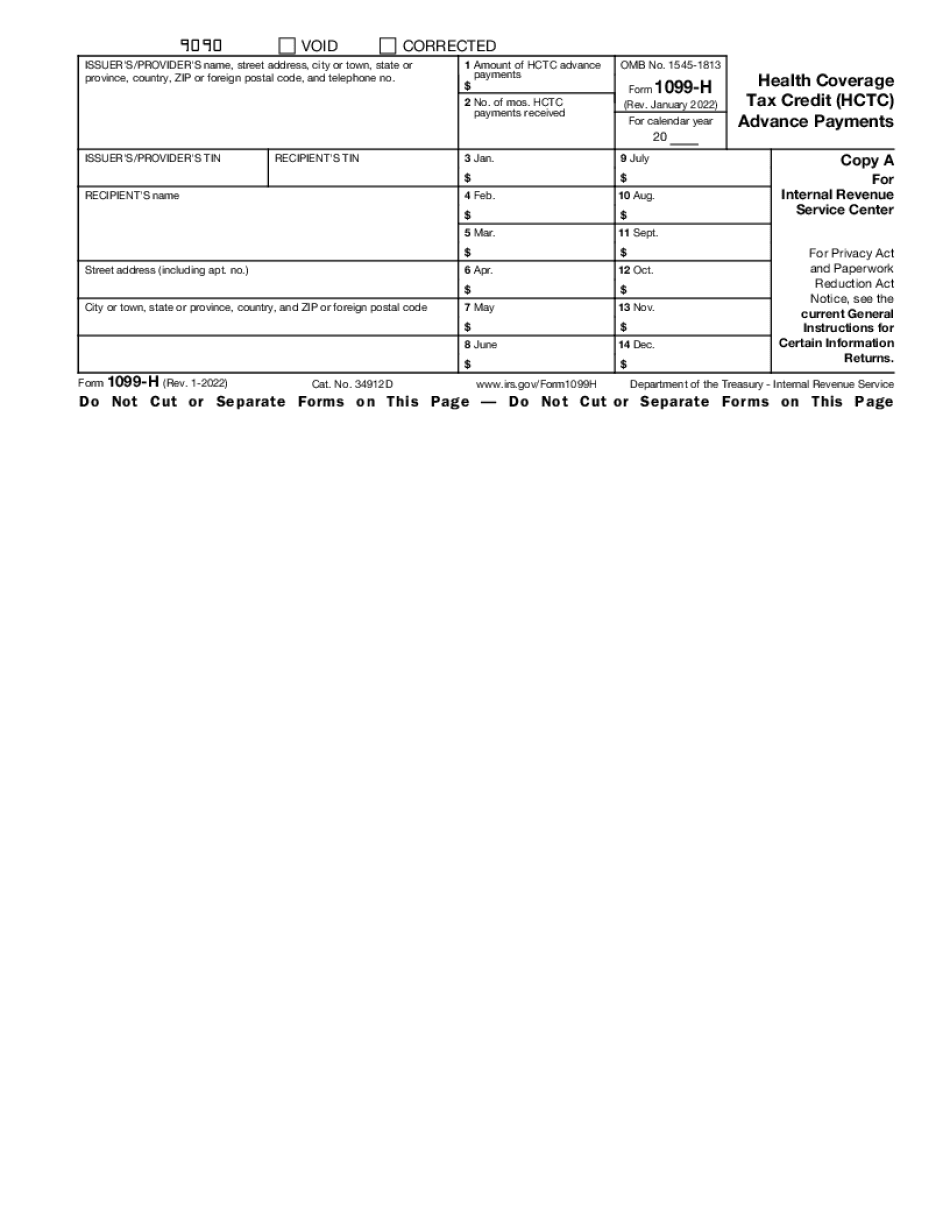

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-H, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-H online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-H by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-H from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 int