Hiring more employees doesn't always seem like the greatest idea. Doing so can be expensive and more of a headache, no matter the industry you're in. One way around this is to hire contractors. And while this is an excellent way to save money, it won't get you out of doing taxes for them. In this case, you need to file a 1099. However, if you don't know the process, then stay tuned. But before we get into the 1099 process, let's review what this form is. What is a 1099 Miscellaneous? The 1099 form is used to document miscellaneous income. You'll send this out to any independent contractors who did business with you in the last year. It is the equivalent of a W-2 form but for outsourced work. You've got until January 31st to get these forms in order and send out. Not meeting this deadline will cost anywhere from $30 to $100 per form. Step 1: Check your information. Make sure you have the current name, address, and social security numbers on file for your independent contractors. This information should have been collected via a W-9 form. If you don't have this information on file, the IRS will allow you to withhold 28% of the person's or company's pay. So, are there any exceptions to 1099s? Yes, there are. Anyone who received less than $600 in payments from you is excluded. Personal payments and transactions are also excluded. Step 2: Grab your forms. You can't download 1099 forms. You have to either order them from the IRS or pick them up at an office supply store. Also, some accounting software offers them, which can save you a ton of money in the long run. Step 3: Fill out the forms. There are three portions to this form. Send copy A to the...

Award-winning PDF software

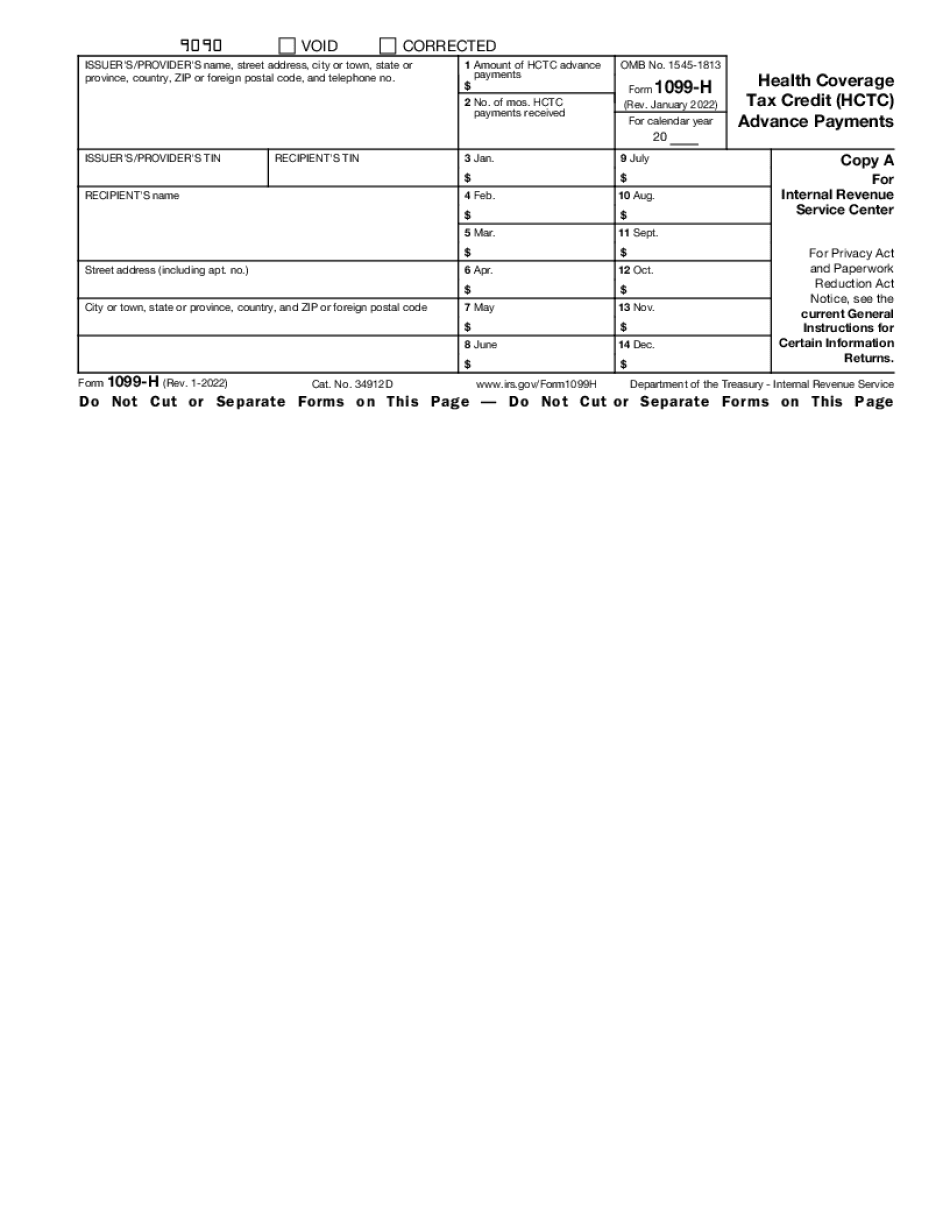

What is a 1099-h Form: What You Should Know

May 10, 2025 — Current unemployment compensation. Note that these payments may be paid by employers, employees, or both. This may help determine whether a State or Local government has a minimum wage exemption. To complete this form in Adobe Acrobat, click here. The number below is the California unemployment program office for your State-allocate the office for your County (or if none exist, you must give the State your telephone address-which may be on your voter registration form) the office will send an e-mail to you the following business day. Use the number after the asterisk above as the address to contact Eddie Donna, EDD, Division of Unemployment Compensation (EDD #), E-mail, eddied.ca.gov. For example, to send the letter to the California Employment Development Department, I'm using their email address of EDD # California: EDD#. I would like the letter sent, and I want them on record. May 23, 2018–Current Unemployment Compensation. In order to complete this form, please have the following information: 1. Employer name (if you work for another entity) if you are filing as an individual. 2. Eligible Unemployment Pay (including number of weeks) 3. EIC amount as shown on Form 1099EZ (California State Unemployment Insurance) 4. Total amount for the calendar year in parentheses. This is a 1099-G, it looks like this; This will show you the employer's name, employee's name and company or labor organization; In the first column (the left side) type the amount as shown in parentheses; This should be 1.5 (1st) or 2.5 (second) Payee Name, Employer (if Employee) and Tax ID Number (if Employee) 4) Optional for an employee is the date the employer filed for unemployment benefits and the date the payment was made. If the amount on Line 5 is less than 5,000 and is a single payment, the column on the right should show the number of weeks the worker should have worked as shown on the Form 1099-EZ.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-H, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-H online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-H by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-H from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is a 1099-h form