Award-winning PDF software

8885 2025 Form: What You Should Know

The CTC will end when the tax year ends on December 31, 2022. If you choose to be treated as a self-employed person, you must use Form 2555, Health Coverage Deduction Worksheet. If you are married or living together, be sure to complete both the CTC and the marriage and tax benefits forms. If you have children and don't claim them as dependents, you may be able to take the health coverage tax credits to help defray the health care expense of some individuals and married couple filing jointly on their particular tax return and not on their spouse's tax return. For the 2025 tax year, the Health Coverage Tax Credit will be for up to 4,835.00 (2018 tax year beginning Jan.1, 2018). If you are a 2025 taxpayer, and have not completed your 2025 tax return for 2025 or 2018, you may file for the health insurance deduction at most, one, two, or three tax years prior to the 2025 tax year if you meet all the requirements and are filing separately and before the end of your first, second, or third years of eligibility for the health care deduction. If you are filing jointly for 2017, 2018, or 2019, and you are eligible for the Health Coverage Tax Credit due to your filing status in 2019, and earn income for the health insurance tax credit the same 2018, due to filing status in 2019, you may claim the health coverage credit for the 2025 tax year, even while you file your 2025 tax return. For more information, complete & file a Form 2555 and include the “Health Coverage Tax Credit” in item 6 of line 14. For more information, complete Form 8885, Health Coverage Tax Credit — IRS, and include the “Health Coverage Tax Credit” in item 6 of line 14. If you have had the tax due since you last filed, it is your responsibility to update your tax information on IRS.gov. You may download Form 8885 from or get it from your local U.S. Tax Office.

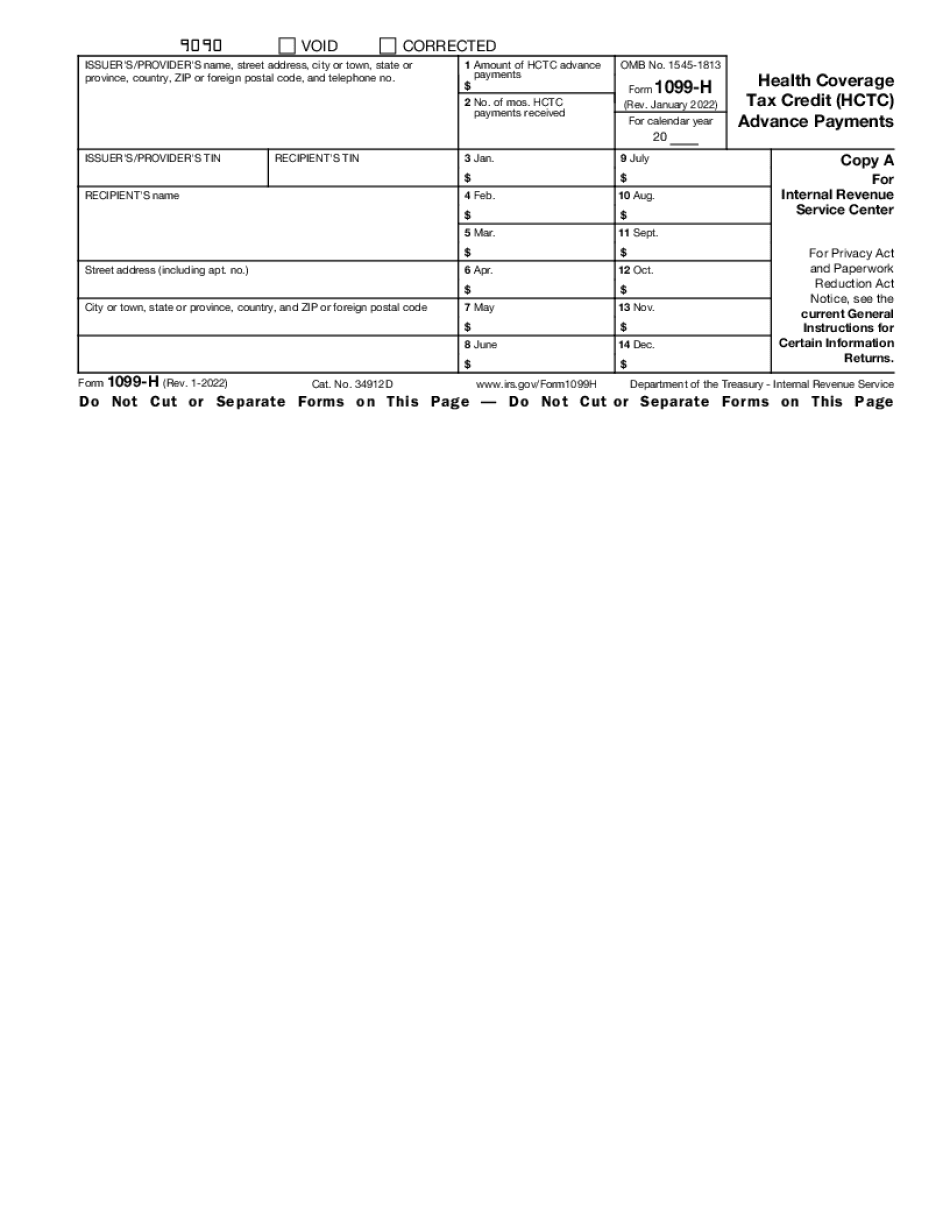

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-H, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-H online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-H by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-H from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.