Award-winning PDF software

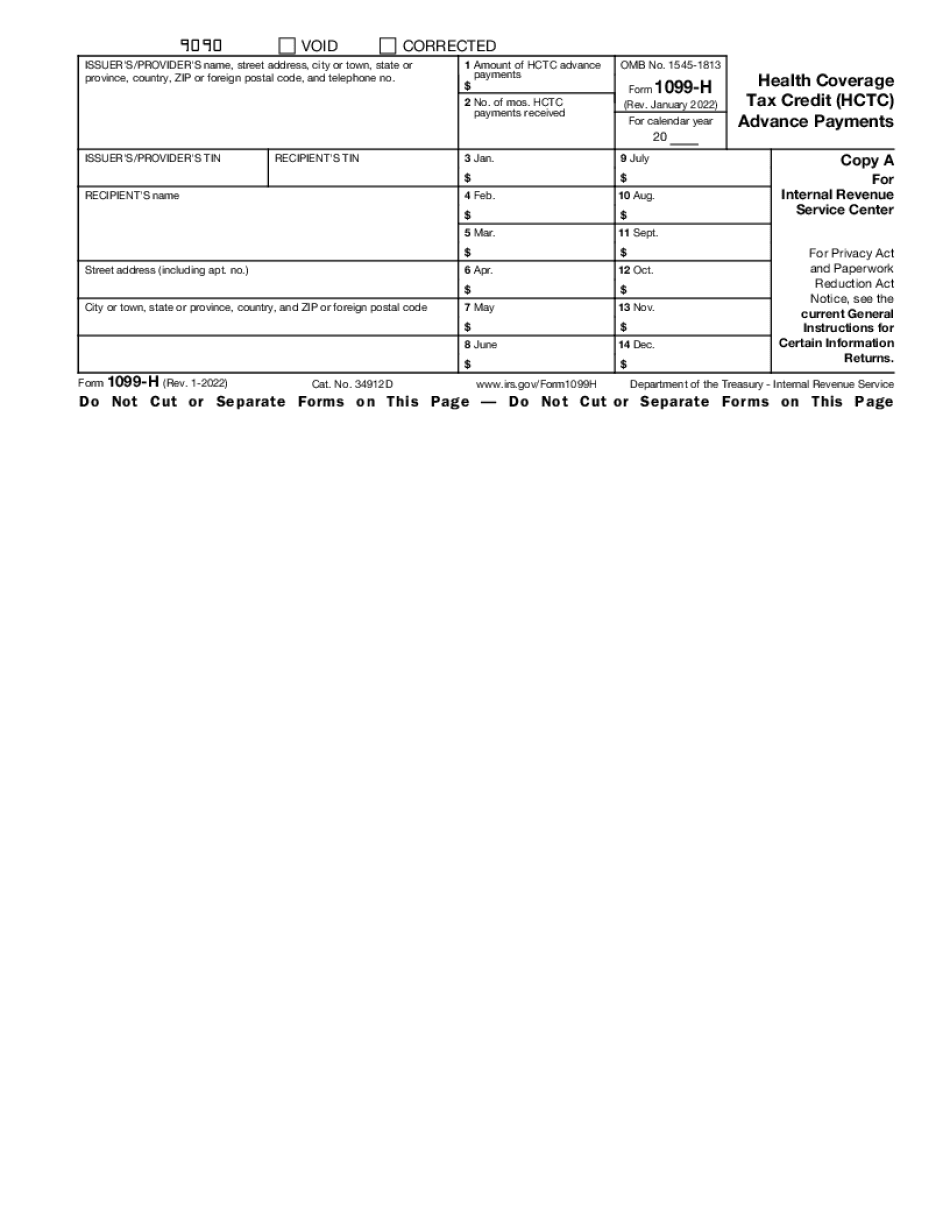

Form 1099-h: health coverage tax credit advance payments

The Form 1095-B (Pay As You Earn). The Form 1095-B will indicate how much is paid in advance to an insurance issuer under an HSA. This form does not disclose your account, nor how much of your income is protected by the account. The Form 1095-B is filed with the IRS. You have to submit a separate Form 1095-H for the HSA. As with any tax return you submit it is important to be accurate. HSA taxes are paid quarterly. The quarterly reporting dates are listed on your Form 1099-Q. If you have paid advance taxes to an IRA, a Roth IRA, or a medical savings account, these accounts will generally be required to pay annual tax withholding. The total tax will be listed separately as an additional tax on line 45 (Form 1040). For 2018, each HSA may contribute an amount to its own qualified medical expense deduction..

form 1099-h software

PDF file with all CTC Advance Payments forms is in CPT File section, just under Form 2115. If your household income is 60,000 or more, your household income must be reported on your return. For taxpayers who have an adjustment for itemized deductions, the household income must be reported on the Form 1040 (or a corresponding statement); the Form 1040(S) or Form 1040A must be used. For the same reason, no other adjustments to itemized deductions may be made on Schedule A (Form 1040A). However, if you are required to file a separate return, you must file Form 1040NR, which is a Schedule C, Schedule A - General Tax Consequences of Itemized Deductions. If you do not file a separate return, you are not required to file a Form 1040NR for the tax year. If your household income is below 60,000, you do not have to file a separate return, so you can.

Form 1099-h online - taxseer

If you reported these advances as income to any of the 1099s that were received for the benefit of an eligible employee, you must remit these amounts as income on Form 1040, line 21, with line 8a and line 8b for the year of the advance payment. If you received a payment from your employer for health benefits, and you did not provide a Form 1099-H to your employer in the year the payment was made, report the payment as cash. Report all other health benefits payments received by you from the employer as health benefits income. This includes payments you received for covered services in an amount greater than the amount of your tax-free tuition and fees, or any supplemental payment that must be reported on Form 10962 or 1096s. A qualified health plan or health insurance coverage is a health insurance coverage which: Provides health benefits for self or spouse or child.

2011-federal-form-1099-h.pdf - taxformfinder

January 11, 2012. 26(b) Health Coverage and Advanced Payment 26(b) Health Coverage Not Included (1) General. (i) Nothing in this section prohibits a qualified student from enrolling in a health and dental plan if the plan offered by the plan's sponsor is not coverage under chapter 7 of Pub. L. 111–148. Examples of policies that are not “qualified coverage” are any type of dental plan and any benefit plan providing coverage under chapter 7 or under the terms of any other health plan. (ii) Notwithstanding clause (i), if this part covers the cost of an advanced payment pursuant to a qualified coverage that provides medical benefits only, a student does not have to report any cost of any health coverage to the plan sponsor. IFAQualified coverage provides medical benefits only, but requires advance payments for the amount paid as part of premium payments, the student's advance payments are not considered.

form 1099-h "health coverage tax credit (hctc

Go to the Health Care Tax Credit Advance Payments page, click on the Advance Payments tab, and fill out the necessary forms and submit. See Form 1095-A for 2018. See Form 1095-B for 2019. See Form 1095-C for 2018; if you are a 2017 taxpayer (with 2017 income and adjustments in 2018), you can't file your 2019 return. Use Form 8859-C (or the Internal Revenue Service/Department of Health & Human Services Form W-2GES for 2017 or 2018) To Claim the Health Coverage Tax Credit and To Claim State Expenses and Additional Credits. Go to the State Expenses and Additional Subsidies page, click on Tax Credit Credits, and fill out the required forms. See IRS Publication 3, Medical Expenses, for 2017 tax year. Download Fillable Ir's Forms 1099-H ITC For Individual And Corporation. Go to the Health Coverage Tax Credit Schedule for Individual and Company, find a form for your type of.