Hello everyone my name is leo resende i'm a cpa and founder of leader associates the topic of our video today is the filing requirements of forms 1099 as it pertains to payments to independent contractors and other service providers in general the irs requires businesses and individuals to file forms 1099 to report total payments of 600 or more that are made to independent contractors attorneys or commercial property landlords during a year these payments were all previously reported on forms 1099-misc for miscellaneous however for 2025 there's a new form 1099-nec for non-employee conversation that will be used specifically to report payments to independent contractors and payments to attorneys for legal services provided 1099 miscellaneous form however will continue to be used to report miscellaneous payments such as rents awards and prizes among others therefore if your company paid 600 or more to a contractor during 2025 you will now use form 1099-nec for non-employee compensation if your company paid 600 or more to an individual or an llc for rent for example you will continue to use forms 1099-misc for miscellaneous payments there are deadlines to file forms 1099 and hefty penalties if you fail to do so the filing deadline for forms 1099 nec is january 31st of the following year and for forms 1099 miscellaneous is february 28th if you follow by paper and march 31st if you file it electronically however if the deadline falls on a weekend or a holiday it is due on the next business day for example for the filing of the 2025 forms 1099 nec they are due on february 1st of 2025 for the filing of the forms 1099 miscellaneous it is due on march 1st 2025 if you file by paper and march 31st if you...

PDF editing your way

Complete or edit your semalt com anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export amazon directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your where to get a copy of my 1099 h as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your Form 1099-H by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

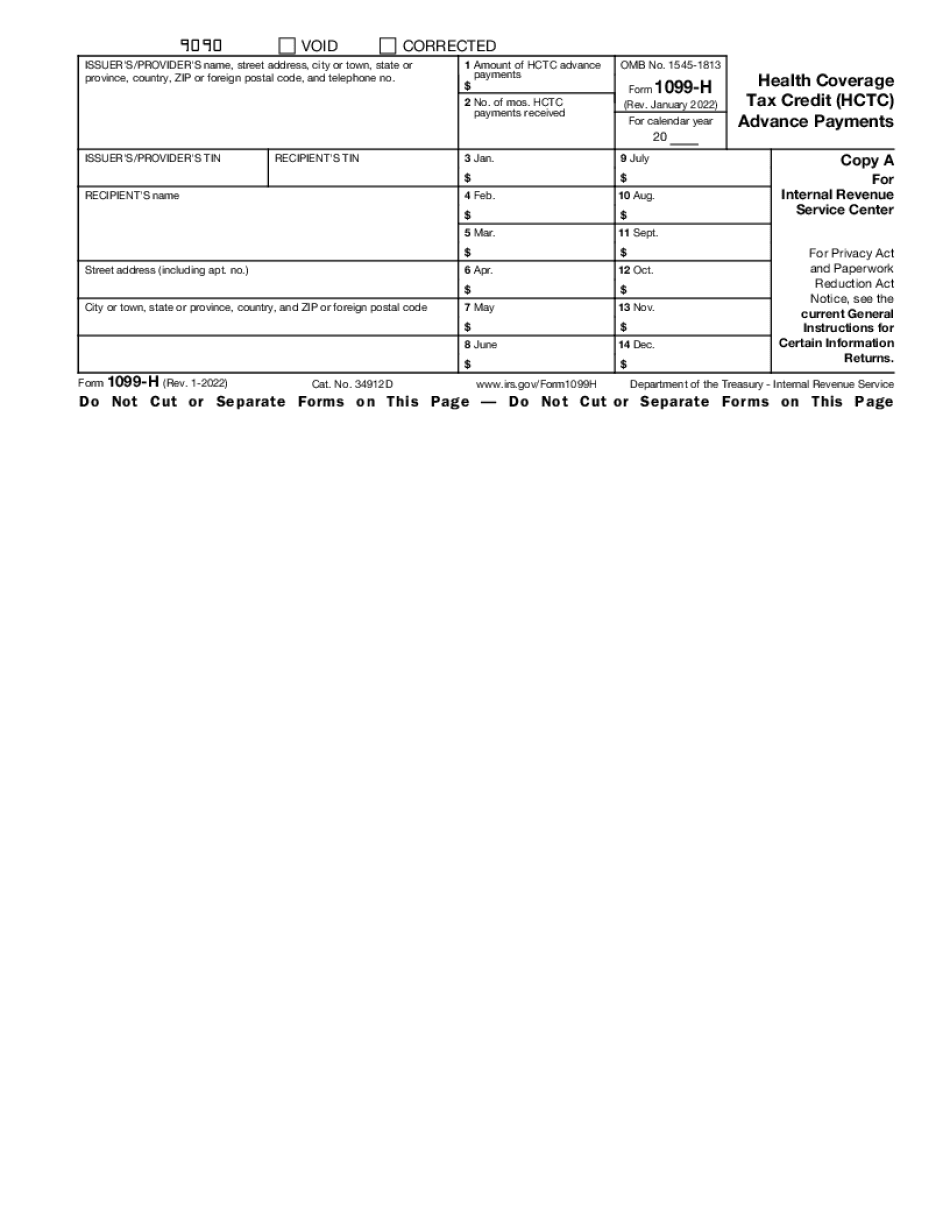

What you should know about 1099 H

- Form 1099 H reports CTC advance payments made on behalf of eligible TAA recipients.

- IRS Form number: 154518131099H2

- Key form keywords: 1099 H, 2020 1099 H, IRS 1099 H

Award-winning PDF software

How to prepare 1099 H

About Form 1099-H

Form 1099-H is a U.S. tax document used to report health coverage tax credit (HCTC) payments received by an individual or household. The HCTC is a tax credit available to individuals who are eligible for the Trade Adjustment Assistance (TAA) program, as well as individuals between the ages of 55 and 64 who receive benefits from the Pension Benefit Guaranty Corporation (PBGC) because their pension plan was insolvent. Form 1099-H is issued by the entity responsible for administering the HCTC program, which is usually the Health Coverage Tax Credit Program Administrator (HCTCPA). It provides important information about the amount of HCTC payments received during the tax year. Individuals who qualify for the HCTC and have received payments under this program are required to report these payments on their federal income tax return. Therefore, those who receive HCTC payments need Form 1099-H to accurately report and reconcile the HCTC payment information on their tax returns.

How to complete a 1099 H

- Additionally, you will need to enter the amount of CTC advance payments received

- Make sure to have all the necessary information and follow the prompts to accurately complete the form

People also ask about 1099 H

What people say about us

Ideas to go paperless at home

Video instructions and help with filling out and completing 1099 H